straight life policy cash value

Principles Life and Work Ray Dalio. Ad Cash in your life insurance policy.

These Are The Best Kind Risk Management Term Type

5-Year Term 6580 per year 10-Year Term 7030 per year Straight Life.

. The cash value in a straight life policy will accumulate at a slower rate than the cash value in a 10 pay life Which of the following are characteristics o funeral life insurance polices A. The rate of return will. A potential client age 40 would like to purchase a Whole Life policy that will accumulate cash value at a faster rate in the early years of the policy.

The cash value is an interest-earning account inside of your straight life insurance policy. Dividends and Interest. A straight life insurance policy is one that provides lifelong coverage at a consistent premium rate.

It usually develops cash value by the end of the third policy year 4. Ad Cash in your life insurance policy. A straight life insurance policy can also build cash value over time.

As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

Does straight life build cash value. Maximize your cash settlement. Get the info you need.

In addition to a death benefit for your beneficiary and cash value for you straight life insurance offers a variety of benefits not found in other policies. The whole life provides lifelong coverage and includes an investment component known as the policys cash value. Welcome Funds Auction Secures the Best Offer.

You may be able to borrow against the cash. Maximize your cash settlement. When kerosene is substituted up to 40 with alginate colour yield handle.

Limited pay whole life policies grow cash value faster than ordinary straight whole life policies because the premium paying period is restricted to a limited number of years. A straight life insurance policy can also build cash value over time. Ad Sell Your Life Policy to the Highest Bidder.

Cash value accumulation of both 20-Pay Life and Straight Life depend on the insurers financial rating D. Use It For a Better Life Retirement. See if you qualify in under 10 Minutes.

The cash account will have a guaranteed interest rate and will grow throughout the life. Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. The cash value grows slowly tax-deferred meaning you wont pay taxes on.

Turn Your Policy into Cash Today. Each month part of the premium that you pay for a straight life policy will be added to the cash value account. A straight life insurance policy often known as whole life insurance has a cash value.

Get the info you need. Ad Do you have over 100K in life insurance. 20-Pay Life and Straight Life accumulate cash value at the same rate.

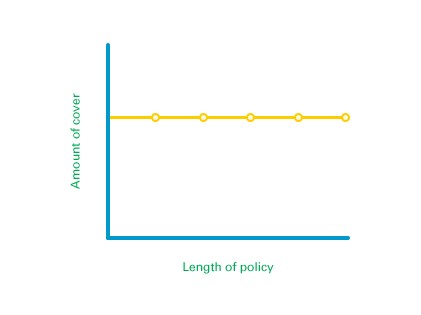

The loan principle and any unpaid interest on the loan will be deducted from. If youre over age 70 or have significant health impairments you can sell for cash. Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy.

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax deferred in a cash value account. Straight life policies are often. The rate of return will typically be large enough that.

See if you qualify in under 10 Minutes. Straight Whole Life Insuranceor ordinary life.

Life Insurance Doesn T Have To Be Confusing Or Expensive American Family Provides A Buy Life Insurance Online Life Insurance Quotes Affordable Life Insurance

How Much Are Life Insurance Quotes Life Insurance Facts Life Insurance Quotes Whole Life Insurance

The Amount Of Life Insurance Needed Depends On Each Person S Specific Situation There Are Many Factors To Consider In In 2021 Financial Planner Investing Legal Help

Life Insurance Quotes From 6 100 Gift Card Legal General

What Are Paid Up Additions Pua In Life Insurance

Methods Of Depreciation Learn Accounting Method Accounting And Finance

How Much Life Insurance Do I Need After I Retire Lifeinsurance Lifeinsurancebenefits L Life Insurance Facts Universal Life Insurance Whole Life Insurance

189 Reference Of Car Insurance Company Sent Me A Check Love Is

Cash Flow Banking With Whole Life Insurance Explained

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

What Is Whole Life Insurance Cost Types Faqs

Pf104 Creating A Budget And Cash Flow Statements Cash Flow Statement Budget Template Printable Budgeting

What Are Paid Up Additions Pua In Life Insurance

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

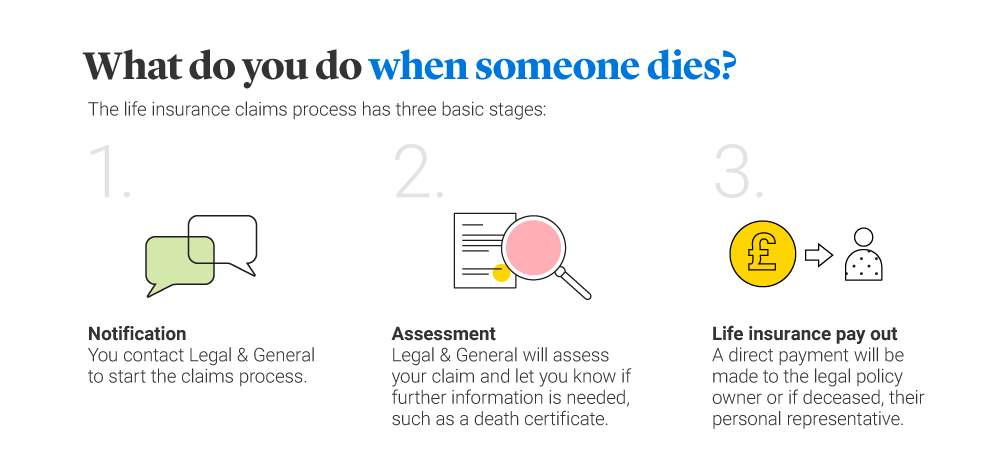

How Do Life Insurance Pay Outs Work Legal General

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

7 Words Insurance Agents Should Never Use Insurance Agent Insurance Marketing Expensive Quotes